Responsible Management Report 2020

7.3. Economic

management

Generated and distributed direct economic value

(GRI 201-1)

2020 operating income

COP 5,4

trillion

Service revenue in 2020

COP 77

billion

In 2020, the Company achieved revenues of COP 5.4 trillion. In the fourth quarter (4Q), it continued to make its sales plans accessible to all, highlighting the contract customers, whose access grew for the 11th quarter in a row and Fiber to Home (FTTH), which now represents 76% of the high speed access base. This progressive improvement in high value accesses is transferred to the accelerated growth in service revenues, which have a year-on-year increase of +1.5% in 2020 (COP 77

billion), thanks to the sales offers that led to an increase in fixed and mobile connectivity, data consumption and the contribution of fiber optics to the portfolio for customers. Other revenues present a year-on-year decrease of 76.7% (-COP 408 billion), mainly due to the decrease in the transfer of non-strategic assets for the Movistar business. This strategy was developed intensely during 2019 according to the plan established for this.

This progressive improvement in high value accesses is transferred to the accelerated growth in service revenues, which have a year-onyear increase of +1.5% in 2020 (COP 77 billion).

Fiber To The Home – FTTH represents

76%

of the high speed access base.

Mobile accesses amount to 16.3 million (+ 1.4% year-on-year) after presenting positive net profit (+560 thousand in Q4 year-on-year; +218 thousand in 2020). In the fixed business, the repositioning of fiber offerings, with increased speed. Likewise, fiber

deployment is accelerated, reaching to FTTH end customers in 2020 to 329 thousand and grows 58% in 2020. In TV of payment, IPTV accesses amount to 187 thousand (35% of total Pay TV), partially offsetting the fall in Digital Television - DTH (-24%) in 2020.

In the fixed business it stands out the repositioning of fiber offers, with speed increase.

16.3

MM

million mobile accesses in 2020

+218

thousand gain net of Access mobiles in 2020

+286

thousand Gain net of 4q in contract

58%

growth in fiber deployment

Accesses to IPTV

35%

of the total paid TV

Service revenues (+COP 75 billion) increased 5.7% in the 4Q year on year (+COP 77 billion in 2020, +1.5%). This was mainly due to mobile data consumption and activation of fiber optics (+4.4% in the 4Q; +5.8% in 2020), as well as the expansion of services through platforms and applications, mainly for integrated solutions and digital services, with a year-on-year growth of 41.2% (COP 125 billion in 2020), which includes services of storage in the cloud, security and applications on demand, offsetting the drop in traditional call services.

Operating expenses decreased 8.8% in the 4Q year on year. This was mainly due to the drop in sales expenses, because of the activation of commission costs generated in obtaining contracts with customers and the costs of

terminals due to the reduction in sales, affected by the health and economic emergency of COVID-19.

In 2020, the EBITDA amounted t

COP 1,660 billion, -13.3% down year on year in 2020

(COP 254 billion), mainly due to the drop in other revenues generated by less activity in real estate sales. The EBITDA margin was 31.0%.

Capital investments (CapEx) amounted to COP 654 billion during the year. CapEx comprises 12.2% of income in 2020 and the OIBDA-CapEx amounts to COP 1,006 billion in 2020.

Capital investments (CapEx) amounted to COP 654 billion during the year. CapEx comprises 12.2% of income in 2020 (19.9% in 2019) and the OIBDA-CapEx amounts to COP 1,006 billion in 2020

Service revenues increased 5.7% in the 4Q year on year mainly due to the consumption of mobile data and activations in optical fiber.

+COP 77

billion

service revenue in Q4 year on year

+5.8%

Fiber optic activations in 2020

COP 88

billion

operating expenses

COP 1,660

billion

EBITDA in 2020

COP 654

billion

Capital investments (CapEx)

Despite the effects of COVID-19 on the level income and portfolio quality for the year 2020, the organic collection levels remained at levels similar to those of the year immediately previous product of commercial initiatives and collection carried out by the company, presenting a decrease of only 1.7%.

During the year real estate sales were made that generated cash worth COP 260 thousand mln. In addition to this, the year was characterized by high financing activity explained by the company debt management strategies, where debt was taken in COP and USD with the bank local and international and the broadcast was carried out of the Senior Bond 2030 in the international market (US 500 mln). The resources taken were destined for the prepayment of the Hybrid Bond (US 500 mln), of the Senior Bonus 2022 (US 750 mln), and the partial prepayment of the syndicated loan (USD 70 mln). Likewise, the positive impact is added of derivative instruments assigned to the prepaid debt which was generated by the exchange rate volatility and strategies structured coverage by the company.

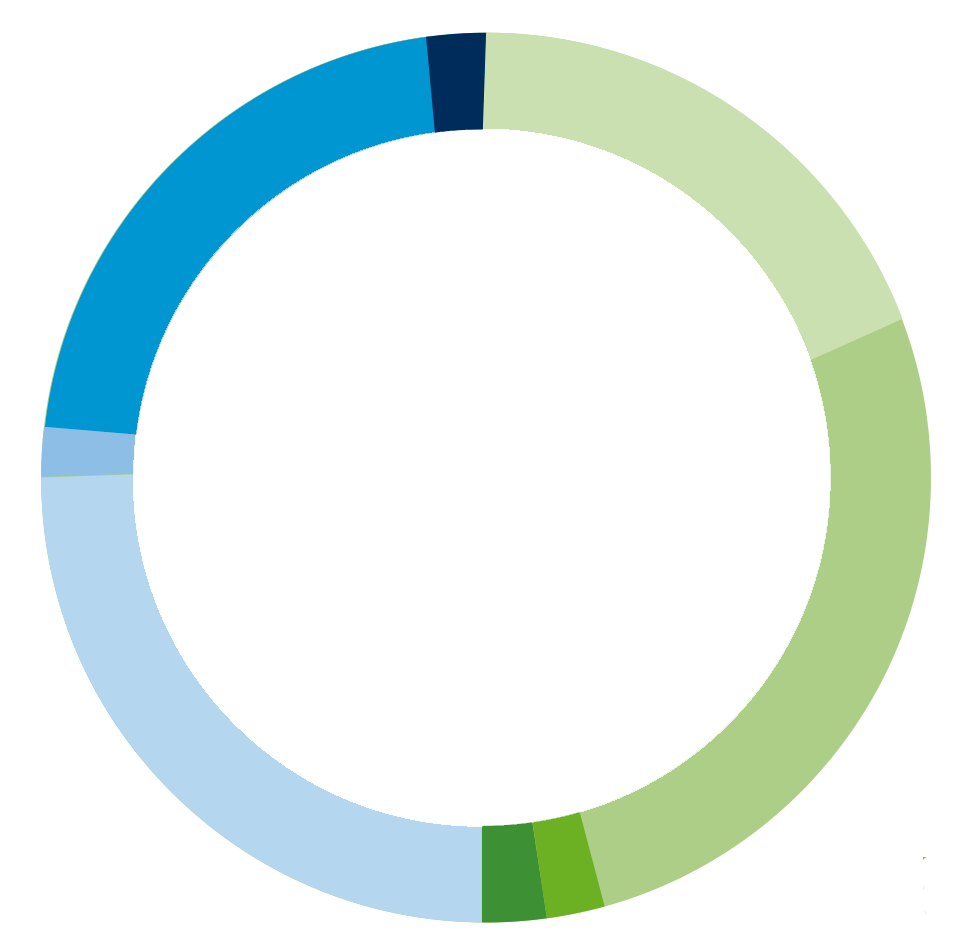

With regard to supplier management, presents a decrease in payments with compared to the previous year explained mainly due to efficiencies in Opex management and lower Capex associated with optimization and prioritization of the same due to the situation of the pandemic. Cash flow presents sources for a total of COP 11,173 million associated with operating receipts, sale of fixed assets and new financing operations; for their part, the uses of cash flow for a total of COP 11,584 million were related to the payment activities of exploitation and investment, payment of taxes and payment of financial debt. The beginning balance cash was CCOP 410,735 million.

Sources

Figures in billions

2020

11.584